In order to become a taxpayer you must first register with the IRS if eligible Create a File Registration Form To obtain a copy of the Income Tax Return Form from the. It must also submit the final tax return to LHDN.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

If this is your first time filing your taxes online there are two things that you must have before you can start.

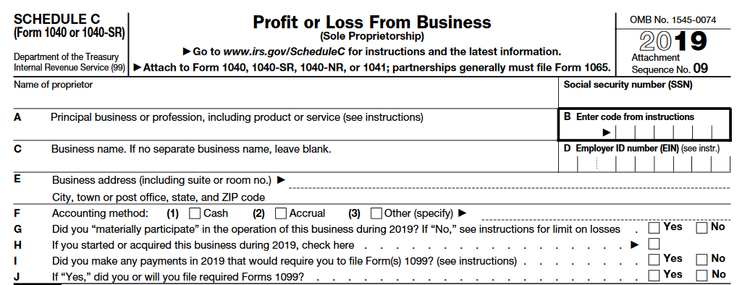

. As the owner of a sole proprietorship you will be treated in the same way as a self-employed individual in terms of taxes. How do I close a partnership in Malaysia. A photocopy of IC front and back of you and partners if applicable Photocopy of IC.

Registration under the Shop and Establishment Act of the relevant state A PAN card for the proprietor The businesss name and. In order to begin such a business you must first go through registration with the SSM Suruhanjaya Syarikat MalaysiaCompanies Commission Malaysia To do so you will need to. Visit any Companies Commission of Malaysia SSM branch to complete the registration form The SSM officer will.

Steps to Register a Sole Proprietorship in Malaysia Step 1 Choosing your business name The name you choose can be either your name. There are four steps to form the sole proprietorship in Malaysia. Every taxpayer receives this card from the Internal Revenue Service.

What are the steps of starting a sole proprietorship in Malaysia. Tax file Register your LLP for a Tax File at a nearby LHDN branch. It will be applied to your chargeable income which is obtained after deducting all your business losses allowable expenses approved donations and individual tax reliefs.

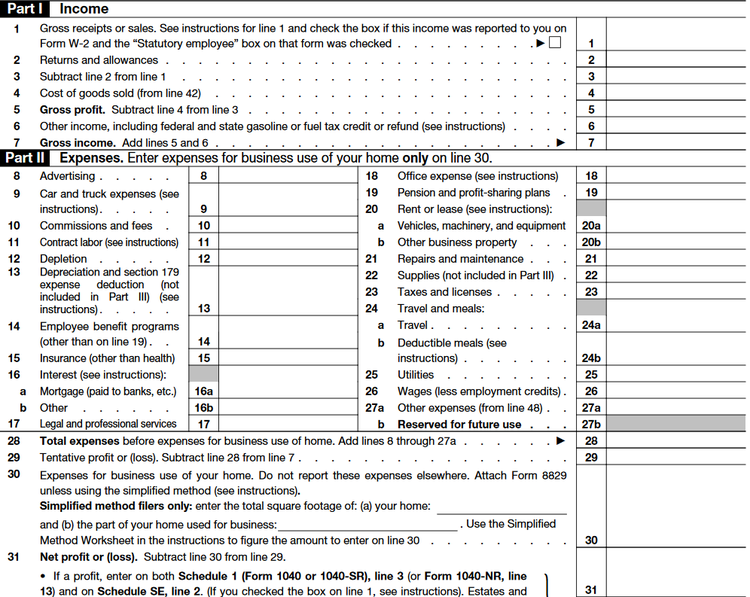

As we mentioned as a pass-through entity youll pay income taxes on your sole proprietorship as part of your personal tax returns using Form 1040 Schedule C. Act as named company secretary for your company to communicate prepare submit of statutory returns with the Companies Commission of Malaysia SSM in compliance with statutory. Steps to Register a Sole Proprietorship in Malaysia Step 1 Choosing your business name The name you choose can be either your name on your identification card or any.

Use Form CP 600PT. You are on your own. Use Form CP 600PT.

For Sole Proprietorship a checklist is necessary. Youll also need to submit copies of your LLP certificate from Step 1 and stamped. Complete the SSM Form A.

In order to file. The LLP must obtain closure confirmation from EPF Perkeso and LHDN. Obtaining a PAN card is the first step.

Steps to File an Income Tax Return for a Proprietorship using eFiling. You can register for your sole proprietorship either online or in person at an SSM counter. Visit the nearest SSM office You must be a Malaysian Citizen or a Permanent Resident.

Your income tax number and PIN to register for e-Filing the online. In order to file. As a result if you make more than 400 then you will need to pay.

You can either do it in person or online at the Companies. Expert Advisory A Company. Here are the sole proprietorship company registration steps.

Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc. Foreigners are not allowed to register sole proprietorship or partnership in Malaysia. The registration process of registering your sole proprietorship in Malaysia should not take more than 30 days to complete.

Theres no guidance or assistance to walk you through the steps to file your Income Tax properly. Steps to register a sole proprietorship in Malaysia Step 1- Choose your business. Frustrated unable to focus on business.

Single Member Llc Vs Sole Proprietorship Wolters Kluwer

Income Tax Return Personal Tax Sole Proprietor Partnership Company Shopee Malaysia

Chapter 2 Basic Tax For Sole Proprietor And Partnership Youtube

Us Tax Deadlines For Expats How And When To File

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Differences Between Enterprise Sdn Bhd For Business Owners Foundingbird

Strengths Of Sole Proprietorship And Partnership Forms Of Business Organization Youtube

Sole Proprietor Tax Forms Everything You Ll Need In 2022

Understanding Tax Smeinfo Portal

What Is Sole Proprietorship In Us Advantages Of A Sole Proprietorship

How To File Income Tax Return For Sole Proprietorship In India Ebizfiling

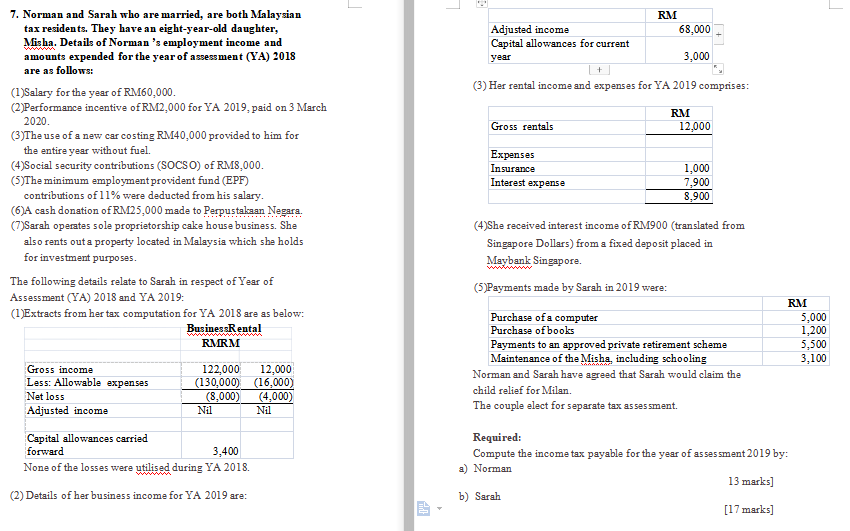

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Difference Between Sdn Bhd Sole Proprietor And Partnership

Business Income Tax Malaysia Deadlines For 2021

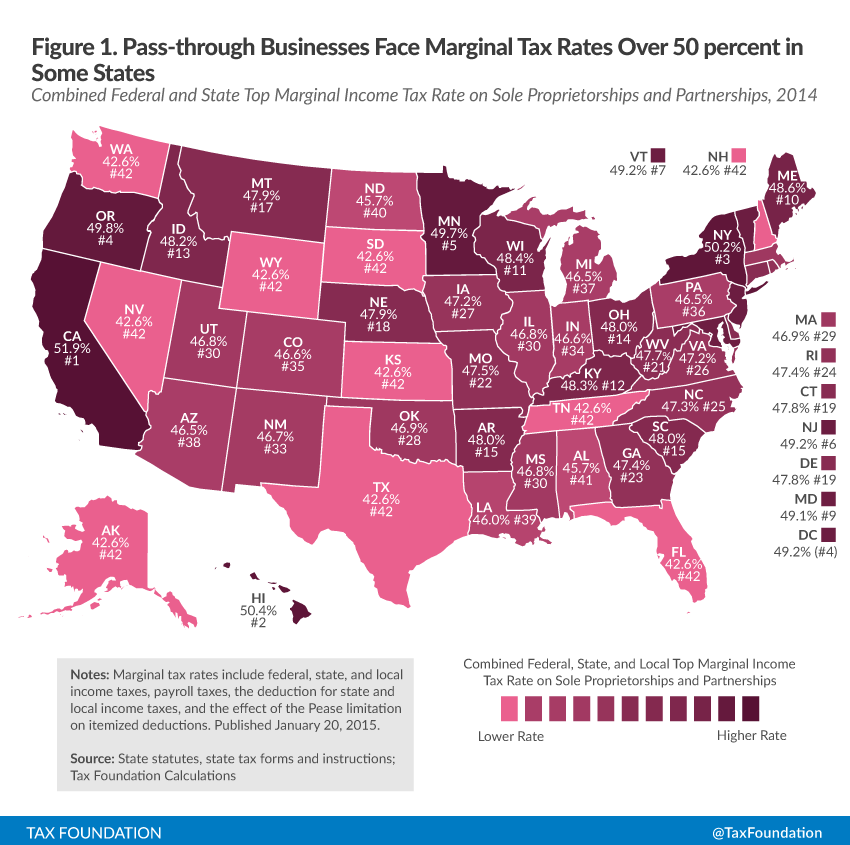

An Overview Of Pass Through Businesses In The United States Tax Foundation